00:00 Introduction

02:05 Boeing 707

05:01 How many parts?

07:07 The story so far

08:50 Definition (recap)

10:03 Crafting a supply chain persona (recap)

12:09 Miami, 10 000-foot view

15:32 The Mission

19:54 Aviation MRO - Operations

20:25 Maintenance operation

27:18 Aircraft part, tangible

34:51 Aircraft part, intangible

37:56 Aircraft units

39:20 Aviation MRO - Decisions

39:36 The Float

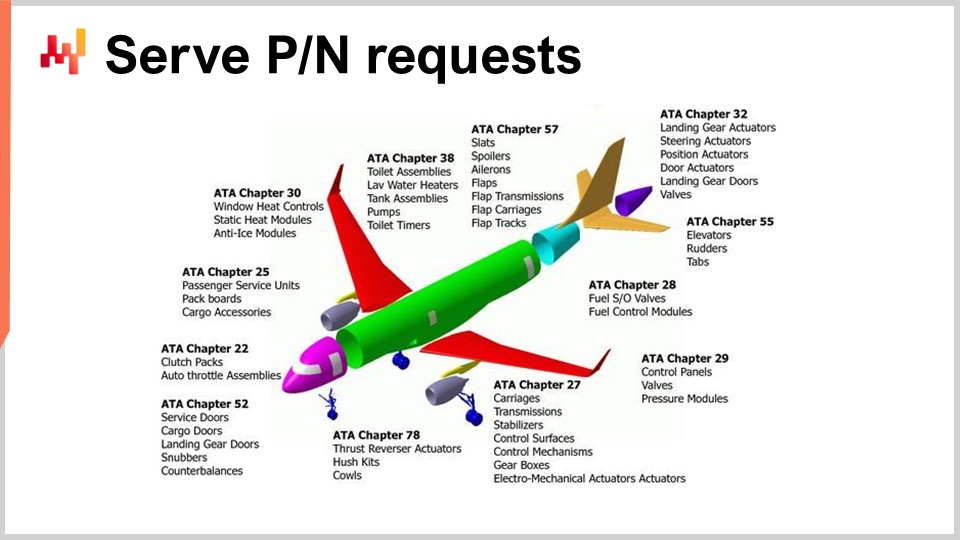

46:37 Serve P/N requests

51:00 Invest and divest

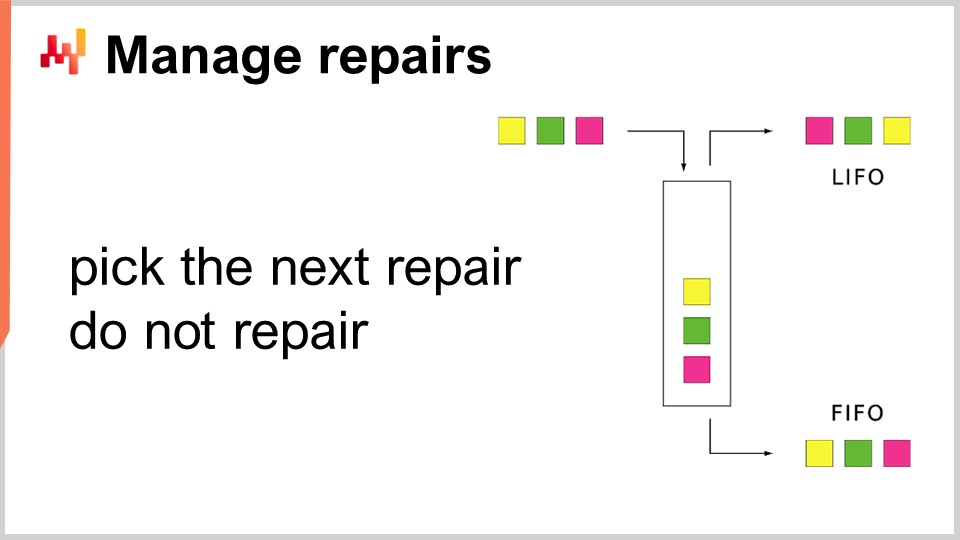

58:40 Manage repairs

01:02:47 Asset Management

01:07:00 Other elements

01:11:56 Conclusion

01:14:38 Upcoming lecture and audience questions

Description

Miami is a fictitious aviation MRO (maintenance, repair, overhaul) in the USA serving a large fleet of commercial aircraft. In aviation, security is paramount. Parts and components must be routinely inspected and potentially repaired. Miami is in the business of keeping aircraft in the air at all times, avoiding AOG (aircraft on ground) incidents, which happen whenever a part needed to conduct a maintenance operation is missing.

Full transcript

Welcome to this series of supply chain lectures. I’m Joannes Vermorel, and today I will be presenting Miami, a supply chain persona. A persona is a fictitious company; in this case, it is a fictitious aviation MRO (maintenance, repair, and overhaul) company. The goal for today’s lecture is to gain a better understanding of aviation supply chains. Indeed, aviation supply chains are a fairly distinct form of supply chain that present a series of specific challenges.

One of my tenets for supply chain is to fall in love with the problem, not with the solution. I believe that classic supply chain textbooks, full of solutions or recipes intended to deliver improvements to supply chains, are mostly irrelevant when it comes to aviation challenges. This lecture will help to clarify why. If you do not happen to work in an aviation supply chain, I still believe that today’s lecture is relevant for you. Due to the distinct characteristics of aviation supply chains, they magnify small differences that exist between verticals, helping you to understand what makes your supply chain specific with regard to other supply chains. Assessing the relevance of solutions is a prerequisite to delivering any kind of improvement to your supply chain. Miami is a fictitious company that we’ll be getting back to in a moment.

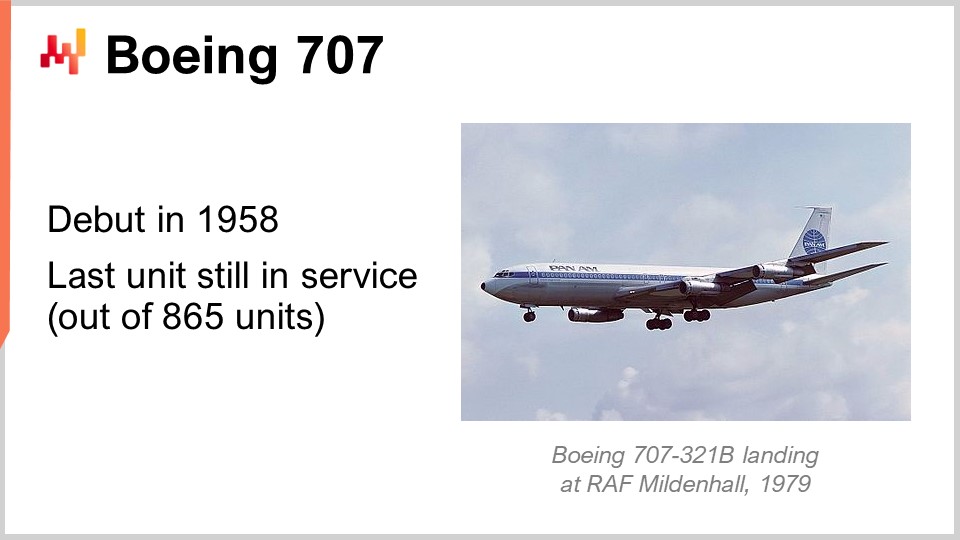

But first, let’s step back in time to 1958. In my view, 1958 marks the debut of the Boeing 707 and the beginning of the modern aviation supply chain era. The 707 has almost all the attributes of modern airliners. It is fundamentally a commercial jetliner with a pressurized cabin, podded engines, and it is produced at scale.

The 707 was not the first pressurized cabin jetliner; that was the Comet in 1952. However, due to a series of tragic accidents, the Comet never became a dominant aircraft. The 707 was also not the first commercial aircraft to use podded engines; the first jetliner to do that was the Caravelle in 1955. Podded engines are a key element of modern aircraft because they allow for the decoupling of maintenance for the airframe and the engine itself. From a supply chain perspective, this offers great modularity, as you can perform maintenance operations more conveniently by swapping the engine and keeping the aircraft up in the air while taking your time to do engine maintenance.

The last innovation that you will find in modern aircraft, not present in the 707, is fly-by-wire, which only happened in 1988 with the Airbus A320. Essentially, fly-by-wire aside, the 707 represents the modern aviation supply chain. So what we have is pretty much 60 years’ worth of the modern form of the aviation supply chain. This industry has matured, and it’s fully established. What we are going to cover in this lecture reflects this very mature, established form of supply chain. I believe that it is quite efficient and will remain so for an extensive period of time, maybe even for a big part of the 21st century. That’s what we want to understand today.

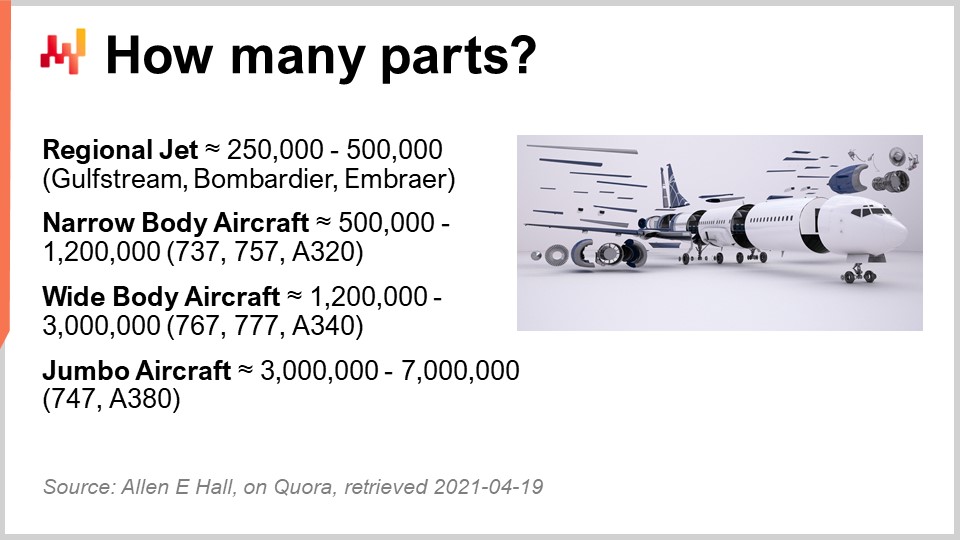

To understand aviation supply chains, we need to start by understanding modern jetliners, which are marvels of human ingenuity. Almost any kind of technology has made its way, one way or another, into aircraft. Advanced electronics, composite materials, advanced engines, advanced models, advanced batteries, and pretty much anything, except nuclear technologies, can be found in an aircraft. An aircraft includes a staggering number of parts, from a quarter million parts for small business jets to several million parts for jumbo jets.

For flight safety reasons, aircraft are fairly long-lived, with a lifespan of around 30 years. Flight safety is paramount in modern aviation, and thus all those parts are routinely inspected, revised, repaired, or changed. The aircraft’s design is extremely modular to make maintenance operations as straightforward, safe, and economically efficient as possible. Due to the long lifespan of aircraft, a significant portion of the aviation market is not about producing the aircraft but maintaining it. This is the business of relevance for Mimi, the persona we are covering today, which deals with aircraft maintenance.

This lecture is the first lecture of the third chapter. In the first chapter of this lecture series, I presented my views on supply chain as a field of study and practice. We have seen that supply chain is essentially a collection of wicked problems, as opposed to tame problems, with adversarial behaviors. As a result, most straightforward approaches to finding solutions or recipes that could deliver improvements to supply chains do not work. A great deal of attention has to be paid to the methodology – not only to achieve results but also to acquire the knowledge needed to support the rollout of solutions intended for the improvement of supply chains.

In the second chapter, we covered a series of methodologies suitable for improving supply chains. The first methodology covered was supply chain personas, which deals with fictitious companies. We have already presented one persona, Paris, a fashion retail network. Today, as the first lecture of this third chapter dedicated entirely to personas, we are presenting an aviation persona for supply chain.

A quick definition, as introduced in the very first lecture of this series, is that supply chain is the mastery of optionality in the presence of variability when managing the flow of physical goods. Mastery of optionality means making decisions when you have options on the table. From an aviation perspective, let’s say we have a part number, and we decide to order one more unit for this part number. This is a decision, and the other options were to order no part numbers, or one, two, three, or up to infinity. Those were all the options, and supply chain is really about the decision-making process for all the things that may or may not happen in your supply chain to deliver the level of service you want to provide.

A persona is a fictitious company. You might wonder why we use fictitious companies. This point was covered in the first lecture of the second chapter, which deals entirely with supply chain personas. As a brief recap, case studies in supply chain don’t work due to conflicts of interest. When a case study is produced, everyone involved has a vested interest in concluding that the solution is effective and delivers significant value for the supply chain. As a result, it’s not surprising that over 99% of case studies available conclude that whatever solution has been studied delivers dramatic improvements to supply chains. I’m skeptical about that, especially in mature industries like aviation supply chains. Most solutions are tentative, and success rates are certainly not at 99% in delivering improvements.

Case studies are essentially glorified information, so as an alternative, we use personas. A persona is a fictitious company, and we only focus on the problem itself. Today, as part of this lecture, I’m focusing on defining the problem we are trying to solve for aviation. The key idea when we think of a persona is to reverse the asymmetry that exists in a case study. In a case study, it is easy to produce but nearly impossible to disprove or debunk. With a persona, we want something that is difficult to produce but fairly straightforward to reject. The rejection criteria were listed in the previous lecture.

Miami is a fictitious aviation MRO (Maintenance, Repair, Overhaul) company based near Miami, hence the name. Let’s assume it was a company that emerged in the 70s with the rise of commercial aviation. I’ve gathered some key figures for you to gain some understanding of this company. Essentially, the bulk of Miami’s business is in long-term maintenance contracts that are closed with airlines. Essentially, the majority of Miami’s business involves serving airlines and meeting their maintenance needs through long-term contracts, which typically last for multiple years or up to a decade. This amounts to about a billion dollars per year, with a profitability of around 5% EBITDA. To achieve this, Miami needs about half a billion dollars worth of stock, which is primarily comprised of repairable parts called rotables, which are quite expensive.

As a smaller activity, Miami also operates a trading desk and an AOG (Aircraft on Ground) desk, which is much smaller, at around 50 million dollars, but with a much higher profitability. This activity involves Miami trading parts to help other airlines that are not part of their pool of clients or even competitors. In terms of the fleet served, Miami services around 1,000 aircraft across 10 different fleets, representing different aircraft types. The company operates two main stores, one in Fort Lauderdale and a secondary one near Seattle, as well as 50 main base kits (MBKs) which are advanced locations that provide a few hundred SKUs each for local maintenance operations.

In total, Miami deals with approximately a quarter of a million distinct part numbers and half a million SKUs. The complexity is very high, and Miami’s business is all about smoothing out this complexity on behalf of the airlines it serves.

The mission of Miami is to keep aircraft in the air at all times. Aircraft are very expensive pieces of equipment, with a typical commercial jetliner costing around 100 million dollars or more. The goal is to maximize asset utilization for the fleet while ensuring safety.

An AOG (Aircraft on Ground) incident occurs when an aircraft is grounded due to any issue that prevents it from flying safely. The most common reason for grounding an aircraft is a missing part needed for routine maintenance. When an aircraft gets grounded, it puts the entire flight schedule of the airline in jeopardy, as flight schedules are interdependent. If one aircraft gets delayed, it can cause delays for other aircraft and may require finding alternatives for passengers. This can result in a cascade of effects and can be very costly. As a rule of thumb, I estimate that a 737 getting grounded for an entire day would cost an airline something like three hundred thousand dollars. If an aircraft gets grounded for a day just because a fifty-dollar screw is missing, that’s an expensive screw.

It’s the weakest link that matters when it comes to grounding an aircraft. It doesn’t matter whether the aircraft is missing an entire jet engine that costs multiple millions of dollars or just one screw; the aircraft will be grounded. Parts availability is paramount for the economic survival of airlines. For example, a 99% service level is not sufficient for aviation. With thousands of distinct parts, a 1% chance of having a missing part means that every single maintenance operation could end up with one or several parts missing, resulting in an AOG every time.

Miami acts as a pool for all those airlines. While Miami holds about half a billion dollars worth of inventory, if every single airline had to maintain its own pool of parts, the sum of all those pools would be much more than the half a billion Miami keeps. Miami leverages larger numbers to have a much higher utilization. The added economic value of Miami is asset mutualization.

The demand for parts is pretty much proportional to the fleet size, although it is fairly random. There are complex maintenance schedules, and there is a large amount of variability because some parts might be repaired, and it’s challenging to know ahead of time exactly what needs to be repaired.

In this presentation on aviation MRO, we will first provide insights concerning the operations to understand what is happening on the ground and the considerations applicable to aviation supply chains. In the second section, we will discuss the types of decisions that need to be made by Miami’s supply chain teams, which is crucial from a supply chain optimization perspective.

Aircraft maintenance needs to be performed on time, and when a maintenance operation starts, time is of the essence. Every minute counts, as a late aircraft can wreak havoc on dependent flight schedules. When the aircraft arrives, the ground teams know what they expect to do in terms of maintenance but don’t know the exact conditions of the aircraft. They will inspect and face what I call a random Bill of Material (BOM). The ground teams inspect the aircraft upon arrival and realize the extent of all the things that need to be changed. Unlike a fixed, deterministic bill of material, where you know exactly what you need, there is a degree of indeterminism here, so you don’t know precisely what you’ll need. Hence, the random BOM.

As a consequence, ground teams are aware of these random fluctuations. When a maintenance operation is about to start, they request greater quantities of parts than they think they will need. For example, if they believe they will need one part but might need two, they will ask for two parts every time and return one unused. About one-third of the inventory movements for many MROs are returns of unused parts.

A crucial element of understanding about parts is the notion of serviceable or unserviceable. There is a preservation of mass as far as aircraft are concerned. If you’re mounting something on an aircraft, you’ve probably just been unmounting something before doing that. A part is considered serviceable if it can be mounted on an aircraft and fly. When a component or part is unmounted from an aircraft, it becomes unserviceable most of the time. It must be inspected, revised, repaired, or directly changed. We’ll be getting back to the concepts of serviceable and unserviceable later in this lecture.

Another essential concept is the standard exchange, which is a matter of supply chain efficiency. When an aircraft comes in for maintenance, the MRO unmounts components that belong to the airline. The MRO then takes a serviceable component, which is their property, and mounts it on the aircraft. Now, the aircraft has a component that belongs to the MRO, and the MRO has an unserviceable piece of equipment that technically still belongs to the airline.

We could potentially decide that the aircraft is going to take off and then return to the MRO a few weeks later to swap the components again because we will have repaired the component that was originally from the airline. However, supply chain-wise, this is very inefficient. It is much more efficient to proceed with a standard exchange, where the component that was the property of the MRO becomes the property of the airline, and the component that was the property of the airline becomes the property of the MRO.

The problem with a standard exchange is that the components being swapped might have different values. For example, the component in the aircraft might have 20,000 flight hours left in it, while the component the MRO is mounting might only have 10,000 hours left. The standard exchange is essentially a financial transaction where you swap ownership but also take into account the delta of value between the two pieces of equipment. This process is very efficient, as it means that the aircraft doesn’t have to return to reset the ownership. The standard exchange is one of the pivotal elements that ensure the efficiency of a modern aviation supply chain.

It also means that, for the MRO, there is a constant inflow of part numbers that were never purchased by the MRO itself. This complicates the supply chain, which we will discuss later.

Now let’s have a look at aircraft parts and their tangible aspects. First, we have the class, which can be rotable or expendable. Rotable parts are typically tracked at the serial number level, and they are often repairable and long-lived. In fact, about 90% of the inventory value possessed by an MRO is comprised of rotable equipment. Expendable equipment, on the other hand, is consumed during the maintenance operation and cannot be repaired.

Then we have the essentiality, which refers to how essential the part is for the aircraft to take off. A no-go part means that the part is absolutely essential, and the aircraft will not take off if it is requested and unavailable. A go part means that the aircraft can take off without it. Typically, it’s something non-essential, such as a piece of cabin equipment. The aircraft can take off, as it is much less critical. A conditional go (go-if) part means that the aircraft can take off but under certain conditions and restrictions. For example, if you have one less toilet available in an aircraft, it may take off, but with reduced passenger capacity. If half of the toilets are unavailable, you have half the passenger capacity.

Every part has a lifecycle associated with it. Many rotable parts have flight hours and flight cycles (the aircraft taking off and landing) in them. When a part reaches the end of its lifespan, it needs to be changed. It’s essential to change parts when you have the chance during maintenance operations; otherwise, if a part expires halfway through your maintenance schedule, you’ll need to ground the aircraft to change that one part. That’s why you typically want to have some safety nets to ensure no part triggers a forced maintenance operation for the aircraft.

Compatibility is something you need to think about in terms of function. A part in an aircraft fulfills a function, such as a pump. There are typically multiple OEMs (Original Equipment Manufacturers) that can provide equivalent parts with distinct part numbers to fulfill this function. When you think about aircraft maintenance, you need to consider the function: do I have a part that fulfills this function?

Compatibility can be tricky. The simple situation is two-way compatibility, where two parts are entirely interchangeable. Part A can be used whenever Part B is needed, and vice versa. However, it’s also possible to have one-way compatibility, which typically happens when you have multiple standards. An aircraft that flies with the old standard can have parts from the old standard or the new standard installed. However, if a part from the new standard gets installed, you can’t mount a part of the old standard anymore.

When you have one-way compatibility, mounting a part of the new standard on an aircraft equipped with the old standard extinguishes the future demand for the parts of the old standard on this aircraft. Keep that in mind for what we’ll discuss later in this lecture when it comes to supply chain decisions.

Units of measure in aviation can be very complicated. You can have things measured in units, just like it is regularly done in many major verticals, but you can also have measurements in terms of surface area. To give you a taste of the problem, let’s say you have 50 meters of cable. It’s not the same if you have one cable of 50 meters that you can cut, or if you have five cables of 10 meters each in your stock. You need to take into account the fine composition of the stock. Additionally, you might be buying the stock in one unit of measure and consuming it according to another unit of measure, which can complicate the situation.

For those of you who are not very familiar with aerospace equipment, anything that can fly is typically very expensive, not only because it’s certified but also because of the extra requirements. For example, a computer keyboard in an aircraft might cost something like twenty thousand dollars. This is because it might have specific safety requirements, such as not emitting smoke that could instantaneously kill the pilots in case of a fire. Anything that flies tends to come with a long list of specific safety requirements, making those pieces of equipment much more expensive. We are looking at very small series and high costs, so we are talking about fairly expensive parts.

Then, we have all the intangible elements associated with parts. First, there are the things that ensure the flight readiness of parts. You have many authorities involved in granting the authorization so that a part can actually fly mounted on an aircraft. Companies like Miami need to have excellent traceability and complete auditability of everything for all their parts. They know exactly all the maintenance operations that have ever happened on the part. If there is any doubt and you don’t have complete traceability, the part is worth its weight in metal, which means nothing. It’s really all the elements that make this part flight-ready that give it value.

A part, especially if it’s repairable, typically comes with a component maintenance manual sold by the OEM. It can get quite tricky because sometimes the same part that is repairable can be acquired with or without the component maintenance manual. This means that there are situations where, if the part was acquired without the manual, although technically it could be repaired, it’s not necessarily feasible because the manual wasn’t acquired in the first place. This complicates many decisions.

When you think in terms of the price of parts, the aerospace and aviation market is fairly complex. You don’t have public quotations for every single part number in the market. So you end up with a certain degree of opacity in this market. For a company like Miami, there is a great deal of effort involved in establishing the fair market value of parts. This represents the sort of price you could expect if you were to sell or buy the part in regular condition. However, the price really depends on the conditions. You have the list price, which is typically advertised by the OEM, but this price can be quite high and doesn’t really reflect the negotiated conditions that a company as large as Miami can obtain if they’re not in a hurry. On the other hand, if there’s an emergency, you may have to purchase the part at the AOG (Aircraft on Ground) price, which can be much higher. To give you an idea, a part might have a list price of $20,000, a fair market value of $15,000, and an AOG price of $30,000. So you see, the price can vary greatly depending on the circumstances.

While some parts are completely standalone and can be changed and maintained in isolation, very frequently, the items of interest are modular units, such as the APU (Auxiliary Power Unit). These units have been introduced in the aircraft to improve the efficiency of maintenance operations and the associated supply chain. The idea is that you can unmount a whole block containing potentially thousands of parts, and then remount a new unit in the aircraft. You typically have Line Replaceable Units (LRUs), which can be changed in the first line of repair, and Shop Replaceable Units (SRUs), which are typically the second line of repairs and happen in the back shops, representing more complex maintenance operations.

Now that we have seen all of that, let’s have a look at the actual supply chain decisions needed to operate and manage all these maintenance operations for Miami.

The first key concept I would like to introduce is the “float.” The naive notion of stock on hand, as far as aviation supply chain is concerned, is vastly misleading. What you have on hand is somewhat irrelevant; what is on hand and serviceable is what matters because you might have parts that are on hand but unserviceable. However, even that is not a good indicator of anything. From a classic mainstream supply chain perspective, you might think that if your stock on hand is at zero, then you need to reorder. But in aviation, that’s not the case because maybe you have plenty of parts undergoing maintenance, and you know that a large number of parts will flow back to your store once they are repaired. Additionally, you may have a lot of parts that will flow back due to unused returns very quickly. Keep in mind that when you buy a part, especially a rotable, you’re stuck with it for a very long time.

The aircraft lasts for something like 30 years, as we have seen, but a typical rotable can last for a decade or more. This means that when you buy a part, you’re stuck with it, and the part is going to be mounted, unmounted, repaired, and it goes in loops. The float is essentially the number of parts that are not attached to any aircraft, and this number characterizes the extra inventory that is available to conduct maintenance operations.

If you could repair parts instantaneously, you would not need a float, because you would unmount a component from an aircraft, repair the component on the spot, and remount the component right back in the aircraft. However, repairing parts takes time. The total amount of time between the request and the renewed availability of a serviceable piece of equipment is called the Turnaround Time (TAT).

The float is dependent on the number of aircraft you serve, as the aircraft generate the demand for parts. It is also vaguely proportional to the size of your fleet and the turnaround time. If you have a longer turnaround time, it means you need to maintain more parts in your float. The float is interesting because it represents your long-term commitment and is invariant with regard to short-term operations that happen all the time in your aviation supply chain.

For example, the float does not differentiate between serviceable or unserviceable parts, as this is a temporary state. A part that is unserviceable will get repaired and become serviceable again, assuming it is a repairable part in the first place. You also have leases and borrows, where you might be lending parts to competitors or borrowing parts from them. The float gives you the long-term vision of where you stand in terms of part ownership that is not readily attached to the aircraft you serve. The standard exchange further complicates the situation.

In order to characterize your float, you need to ask if it is too much or too little. As mentioned, it depends on the demand (size of your fleet) and the turnaround time. The turnaround time is the time it takes between the moment when a part is requested, with the expectation that it should be serviceable, and the time that the component is returned to your store with renewed serviceability. A standard exchange will most likely happen during the operation of aircraft maintenance. You ship a part number, it is swapped with another part number, and this other part number cycles back to be repaired and eventually returns to your store.

However, you have a problem when the standard exchange occurs – you’ve got a mismatch between two part numbers. Typically, in most maintenance operations, people do not keep track of the pairing, so a part number is mounted and another is unmounted, without keeping track of the pairing from an ID perspective. This makes computing the turnaround time difficult, as you see a constant stream of part numbers being sent to your clients or facilities, a constant stream of part numbers being moved away from your store, and a constant stream of parts being received back. The pairing can be lost, which can be very tricky. In a nutshell, the float characterizes the long-term buffer that you have to efficiently serve your fleet and avoid disruptions.

Now, let’s discuss the actual decisions made for aviation supply chains. The first decision you need to make is, when you have an incoming request for a part number, what are you going to serve? Among your stock of eligible, serviceable parts with the same part number, you might have multiple units that you can serve. In practice, there are a lot of additional complications with regard to contractual agreements with each airline served, but I will not delve into these details in this lecture.

You might think to serve the serial number that has the highest number of flight hours and flight cycles left in it, as it is advantageous to mount a part on an aircraft with as much remaining flight hours and flight cycles as possible. This way, the part doesn’t trigger excessive maintenance operations in the future, which can reduce the number of maintenance operations required for that airline or aircraft.

However, you also face another problem: many parts, though not all, have a shelf life. This means that, for example, every six months, the parts need to be inspected, revised, and potentially repaired to some extent, even if they were not mounted on an aircraft. This means that although you don’t necessarily want to implement a “first in, first out” approach, you still want to pick parts that typically have the highest level of shelf life or flight hours remaining. However, you don’t want to leave the same parts on the side indefinitely because you can incur costs as you wait for the parts to expire, which can lead to maintenance operations for parts that aren’t even flying.

Remember, parts serve specific functions, so when you receive a request for a part number, it will match the part number currently in the aircraft. However, you’re not obligated to serve the exact same part number; you can serve a compatible part number instead. This can be especially useful if, among your client airlines, you have variations in your contractual obligations. Some airlines might request a specific part number to be served, while others might allow for either the requested part number or a strictly equivalent, compatible part number. You need to cherry-pick the right part from your stock to be served, making this decision every single time you service a part. Also, be aware of one-way compatibilities when dealing with old and new standards, as prematurely migrating your fleet to the new standard could leave you with a pile of dead stock consisting of old standard parts that cannot be mounted on any aircraft.

The second decision involves sizing the float, typically done through investment and divestment. The question to ask is if you have only one extra dollar to spend on your inventory, which part number would give you the biggest reduction in AOG incidents per year, considering the current state of your fleet? This is the way you want to drive your investment: invest in the part that gives you the biggest reduction in AOG incidents. Once you’ve invested in this part, if you have any money left, you can decide to buy a second part, and so on. You need to think in terms of dollars per amount of AOG incidents reduced per year, as this is the key metric.

A company like an MRO provider is in the business of avoiding AOG incidents on behalf of their clients and keeping the aircraft flying at all times. That’s why it’s crucial to optimize investment. Once you invest in a part, you’re somewhat stuck with it. When considering wise investments, you need to take into account all the alternatives that exist. For example, when considering dollars invested, you should think about the alternatives. If you have a part where an AOG incident is unlikely because the part is readily available in the market, the AOG price might be very low. In some circumstances, the AOG price might be almost equal to the fair market value. In such situations, you want to assess the extra AOG incidents you’re solving compared to an alternative option, which is not buying the part and not including the extra unit in your float. When the day comes, if you face an AOG incident, you will have options to exercise at a later date. If these options are essentially identical to purchasing ahead of time, they might be better because you’re not stuck with the part beforehand. Maybe the AOG situation will never happen, and in that case, you’ve saved yourself the entire spending for the part. This needs to be taken into account.

As parts can have a very long lifespan, you also need to consider the future evolution of your fleet. If you’re buying a part now that will remain functional for, say, two decades, and if this part is only of use for a specific aircraft model like the 747, you need to take into account whether any 747s will still be flying in 20 years. The evolution of your fleet and whether a part will be needed for older or newer aircraft is an important factor in assessing the value a part brings to your float.

You can not only buy a part but also sell a part, and you need to apply the same reasoning in reverse. If you can establish a list of parts to buy, you can also think about which parts to sell that would give you the largest amount of money back for the least amount of increased AOG incidents. When you sell a part, you will marginally increase your risk of facing an AOG incident. Therefore, you want to think about selling a part that will bring you the largest amount of money per AOG incident that it would cause. It’s the same reasoning, but at the opposite end of the spectrum.

In aviation, there are trusted marketplaces, like the “eBay” of aircraft parts. One such marketplace is ILS, which is well-known and operated by trusted players. These marketplaces make it possible to resell parts, and through continuous investment and divestment, an MRO provider can ensure that the composition of its float remains synchronized with the needs of the fleet. Aircraft enter and exit the fleet routinely, especially when dealing with thousands of aircraft. Every single week, there will be aircraft entering or leaving the fleet, and the aircraft themselves are aging over time. Their needs change slowly, and the composition of the float needs to accommodate the fact that the needs of the fleets you serve are slowly changing. This is done with investment and divestment decisions. This decision-making process also needs to be applied to main base kits (MBKs), which are advanced inventory locations on sites along with the airlines. These stocks are for light maintenance operations that can sometimes be performed by the airlines themselves.

Scrapping is another aspect to consider. A part is repairable, but sometimes a repair is not successful and the part fails quality control after repair. It then needs to be scrapped. Scraps are interesting in terms of investment because if a part has a high scrap rate, it means that every time a part gets scrapped, it undoes your investment decision. This is beneficial because if you invest in parts that get heavily scrapped, you’re not taking as much risk as if you invest in parts that never get scrapped. This aspect has a negative effect on the parts you would like to divest.

We have the repairs to manage, so remember, we have parts that are components that are unmounted, they are unserviceable, and they are flowing back to you. Now, you need to decide what you’re going to do with those. The first thing is that whenever a component or unit is getting repaired, this unit is also going to have a random bill of material situations. So, you will face a random BOM as well. You know that the component is coming back to you, and you can kind of expect what sort of parts you will need to complete the maintenance of this unit. But then, when you get the unit itself and you open it, you discover the fine print of what is actually needed. This sort of random BOM does not only happen in the first frontal maintenance operation that I was describing, but it also occurs when you are organizing the repairs of the components.

That’s where it gets very tricky in terms of turnaround time. I described the sort of relationship that exists between the float and the turnaround time. Whenever a part is missing to conduct a repair, it means that the repair is going to be delayed until you receive the part to conduct the repair. It’s interesting because if you have a longer turnaround time, then you typically need a bigger float to address that. But a bigger float means a larger stock. If you have more stock, it can mean better quality of service to operate your repairs, and thus it will, in turn, reduce the turnaround time. You have all sorts of coupling over the place that really complicates the picture, and yet it’s very important because those turnaround times are essential.

First, you need to decide what the next repair is. Imagine you have plenty of parts that you can repair, but your shop has a limited repair capacity, so it needs to prioritize and schedule the order of the repairs. You need to think in terms of what is the most urgent. Obviously, if you have a part where accidentally you have no serviceable parts left, then it is probably a case for a high priority repair. You need to take into account the exact spot condition of your store in terms of serviceable parts to prioritize the parts where you are most critically in danger of facing an AOG situation. That should prioritize the repairs.

There is also the opportunity of not repairing the parts. As a rule of thumb, repairing a part can cost something like one-third of the original cost of the equipment. Obviously, these numbers vary enormously depending on the type of component we are looking at, but as a ballpark estimate, one-third is a typical estimate that makes sense. There are situations where it makes sense not to repair a part and keep a stock of unserviceable parts. This can be of interest, for example, during a pandemic, like in 2020, when there is a drastic drop in activity. Maybe you don’t need to repair all the parts temporarily; you can just postpone the repairs and save the cash. Postponing the repair can save a lot of cash in the short term, and that’s a very reversible mechanism at your disposal.

Lastly, we have asset management. As I said, flight safety is paramount, and just second to that is keeping aircraft in the air at all times. What could happen when a part is missing is that you have an AOG incident. The asset management division is typically dedicated to dealing with those situations. A company like Miami, a large MRO, typically has an AOG desk that is open 24/7. Aviation actors can submit a request for quotation, asking for a part number to be provided under AOG conditions. These actors can either be airlines not part of the pool served by Miami or even competitors of Miami that have a need for their own operations.

Whenever there is an incoming request for a part number, the question is essentially twofold, assuming that Miami has at least one serviceable unit at its disposal. The first question is what cost is incurred by Miami if it serves this part to whoever is requesting it. If you serve the part, it means you have one part less available for your own operation. You might be solving an AOG situation for one of your competitors, but you’re taking the risk of creating an AOG situation for yourself. The first element of answering this question is to assess, in dollars, the risk created by doing that – just the cost side of the equation.

The second part of the question is the markup – how much risk you incur and how much margin are you willing to take. An AOG desk works with pretty much short-lived auctions. The company requesting the part number is probably going to send the RFQ to a dozen companies and, within two or three hours, collect the answers they received. They will make a decision among those very trusted players, going for the cheapest option or taking into account the fact that some actors might be much closer than others, potentially in the same airport.

In terms of markup, the first element of the analysis is the cost and the extra risk you create for your own supply chain. The other one is the markup, knowing that the bigger the markup, the smaller the odds that your offer gets ultimately selected. It’s a sort of auction mechanism where you want to have a markup that maximizes the volume of margin you’re going to make, knowing that it’s an auction game being played. You want to be just one dollar below the other competitors but not more because then you’re just leaving money on the table. By the way, when a part number is requested, your answer doesn’t have to be that exact part number; it can be another part number that belongs to the same function. Compatibility works, and if an airline is facing an AOG situation, they might be willing to take a compatible part number, granted that it’s completely trusted and has complete flight readiness attached to it.

We are nearing the end of this lecture, but there are still plenty of other elements we could go on for another hour or so or maybe a couple of hours. I’m just going to mention briefly other elements that I haven’t even touched so far: marketplaces. Marketplaces are of high interest in the aviation supply chains, and they are fairly active. Components can live for a very long time, so you can sell secondhand or buy secondhand equipment, and all of that is operated by highly trusted actors. From your float perspective, you can have opportunities; for example, a part that is usually not at the top of your investment list doesn’t deliver the biggest bang for the buck, but if there is a spot opportunity to buy a part on the cheap, then suddenly a part that was not really interesting becomes very interesting.

Suddenly, a part which was not really interesting becomes very interesting just because somebody posted it on the marketplace at half the usual price for any reason. One of the reasons why there are sometimes large fluctuations in the price of parts is that aircraft get dismantled. When an aircraft is taken apart, they try to salvage all the value they can. When an aircraft gets decommissioned, typically there are plenty of parts in the aircraft that are not nearly as old as the aircraft itself. There are many parts that might have been mounted just a few months ago, so there might be plenty of equipment that is still fairly new, even if the aircraft is fairly old. All these parts are going to go directly to the marketplace, leading to an influx of extra supply and large variations in price. So there are opportunities to buy parts on the cheap.

Retrofits are another aspect to consider. Flight safety is paramount, so if an OEM (Original Equipment Manufacturer) has any suspicion of having a safety problem with one of their equipment, they might trigger a retrofit. A retrofit involves the OEM pushing new parts that should replace all the existing parts for every single unit that was ever pushed to the market. The OEM takes the initiative to push these new parts for all the fleets. In terms of supply chain analysis, inventory movements resulting from retrofits can be confusing because they are not parts being requested but rather parts being pushed by the OEM itself. This can complicate maintenance schedules later on, as the retrofit can synchronize the maintenance schedule of all those parts across all the aircraft that are eligible.

Grounded fleets are another factor to consider. Although infrequent, every two or three years, one fleet may get grounded, typically for safety reasons. The last one was probably the 737 MAX. When this happens, demand for an entire segment of aircraft parts can be extinguished from one day to the next. There are complex relationships between the aircraft that stop flying and the parts that will be requested in the future, but grounded aircraft really complicate the picture.

Finally, jet engines are another important aspect. Aviation is very specific, and for those familiar with other verticals, they would probably agree that it’s unlike many other industries. Jet engines are like a world inside the world of aviation, with many specific complexities that won’t be touched on today unless there are specific questions about it.

Finally, just like aircraft, the aviation supply chain is all about cycles, such as takeoff and landing. You want to be able to repeat this cycle endlessly and flawlessly. Aviation supply chains are about loops, as opposed to most other supply chains, which are linear, going from producer to consumer with a series of hops. In aviation supply chains, rotable parts, which represent the vast majority of the value, just circle. Mastering these loops is the essence of the aviation supply chain.

I’ve discussed aviation supply chains, but there is also the broader segment of aerospace, which includes both aircraft and helicopters. Helicopters are managed pretty much the same way as aircraft in terms of supply chain management. Aircraft and helicopters are managed similarly to what I’ve described today, although helicopters represent only a small fraction of the aircraft market, around five percent or so. Commercial aircraft are the dominant segment in the industry. If we look at space equipment, currently, space is not a substantial part of the supply chain. However, if companies like SpaceX succeed in developing the space industry at scale with reusable equipment, we could see a shift in supply chain strategies. With traditional rockets, there isn’t a space supply chain since rockets are rarely fired and not reused. However, if reusable rockets become more prevalent, the supply chain strategies for aerospace could include space equipment, alongside aircraft and helicopters.

My take is that the aerospace supply chain discussed today will likely remain prevalent for a significant portion of the 21st century. In the coming decades, it might also include space equipment as a part of its scope.

Let’s address some questions.

Question: Is there a difference between the float and the pool?

Fundamentally, the float is a metric that characterizes the activity of a specific function or part number, and you want this number to be resistant to short-term fluctuations. The pool, on the other hand, refers more to the routinely available stock in the store. It represents the economic entity or business unit with all its associated inventory. The float is a numerical artifact, often tricky to compute, and getting an accurate depiction of the float is usually a non-trivial undertaking. However, it is essential for making correct investment and divestment decisions. The pool, conversely, is more about the economic vision and not really decision-oriented.

Question: _How are random BOMs managed from transactional perspectives in ERP, WMS, etc., given that they can’t work with randomness?

The answer lies in the fact that random BOMs do not exist in ERP or WMS systems. Instead, during maintenance operations, technicians list all the parts they use, typically scanning them with barcode readers. This list constitutes the BOM. These random BOMs are not pre-verified; instead, the maintenance operation records the list of parts consumed during the process. You can think of random BOMs as a phenomenon that occurs, while a probabilistic BOM is a specific modeling perspective. For example, at Lokad, when we face random BOMs, we adopt a probabilistic perspective. That’s a modeling perspective, so we have the phenomenon of random BOMs, and then we have the modeling approach, which is the probabilistic BOM, which is the way we start to think about the phenomenon from a statistical perspective. There would be other non-probabilistic approaches to deal with that.

Question: The cost of conducting service on aircraft mostly automating the benefit of deflating hour cycle on existing space, the cost of conducting services, and heuristics to pick the part with the most hours or cycle left?

The answer to this question really depends on the value of the part being considered. In an aircraft, you have some parts that are worth very little, while others, like jet engines, are worth millions of dollars. The more expensive and critical the part is, the more you can afford to put the part on an aircraft with a small reserve of flight hours, as it makes more economic sense. However, there are plenty of other considerations. In aerospace, the price of parts is very high, and what really matters is not whether you put one or three people to do the maintenance, but rather whether the maintenance happens on time, as not doing so can wreak havoc on the entire airline’s flight schedule, which is extremely costly.

Question: Is there any organization which is pulling out the inventory of space required for aircraft held by various operators?

Yes, there are companies whose primary value is to maintain a pool of parts for other companies to utilize during maintenance operations. One example of such a company is Spairliners in Germany, a long-time client of Lokad. Spairliners was created as a joint venture between Lufthansa Technik and Air France Industries for the launch of the Airbus A380, the largest aircraft ever produced by Airbus. Initially, Spairliners acted as a pool of parts to support the consumption of both Lufthansa Technik and Air France Industries, two large European MROs with plenty of repair capabilities of their own. So, it does exist and makes sense in certain situations.

Question: Sometimes you don’t know if a part becomes serviceable again after the repair. How to compute the probability of becoming serviceable again?

The scrap rate, which is the probability that a part will be scrapped after the repair, can be estimated based on historical data. However, it can become difficult when dealing with parts that get repaired infrequently or are relatively new in the market. In such cases, you can refine your estimate of the scrap rate by looking at parts with similar mechanical characteristics, such as their location in the aircraft, type (pneumatic, electronic, etc.), or whether they are static or mobile.

Question: Does the existence of units change the cost of conducting service, since other parts will need service and any parts with cycle left in excess are fine?

Absolutely, the existence of units does change the way services are conducted. Parts are very modular, which allows for flexibility in conducting repairs. For example, if you have a large and complex unit, you can choose to open the unit and change a subunit that is itself a major component. This can help accelerate the repair process. Alternatively, you can open the total unit, open the subunit, and only change the specific part that is needed. Units have been designed with modularity and maintenance in mind. These units are in place in aircraft to provide a multitude of options when it comes to repairs. You may want to be very swift and change the jet engine entirely, or perhaps just change a few parts within the engine, or do something in between. Modularization is key because of the enormous number of parts involved, and it is essential to have plenty of alternatives.

One option when you need a part is to cannibalize an existing unit. If you don’t have any spare parts left but know you have a unit that contains the needed part, you can open the unit, cannibalize the part, and then fill the gap later on. There are many trade-offs involved, and due to the high cost of parts, it is reasonable to have an engineer spend time considering the best course of action for a single part. This is where aviation supply chain differs from other industries where you would never spend an hour of engineering thinking time just for one part.

Regarding upgrades and changes in part numbers, when you invest in a part, especially if it’s a long-lived part that will last for decades, you need to look far into the future and consider the fleet you will be serving. For example, if you have a small section of your fleet that needs a part, and it’s a very small section, but you know that this part will be needed by the Airbus A350, a rising fleet, you might decide to buy those parts in advance. This is a gamble, as you don’t know the future perfectly, but it can be a wise investment in terms of modifying your fleet. You need to think about the evolution of the industry and anticipate future demand.

In the aviation industry, evolutions happen slowly, and you often know about them years in advance. For example, with the A380, the jumbo jet from Airbus, people knew years in advance that the business was not going well for the A380, and the number of units ordered by airlines was stagnating. Eventually, there were not enough orders, and Airbus decided to discontinue the future production of this aircraft. As a result, you have a clear view of the number of A380s that will be flying in the future. The only remaining uncertainty is whether some aircraft might be decommissioned and disassembled earlier than anticipated. There is a wealth of knowledge available, but the good news is that this knowledge is typically at a very granular level, such as the type of aircraft or fleet, so you don’t necessarily need to have specific knowledge at the part number level.

That concludes today’s lecture. The next lecture will be in three weeks, on the same day of the week, Wednesday, and at the same time, 3 p.m. Paris time. The topic will be “Modern Computers for Modern Supply Chains.” The idea is to alternate between one persona and one lecture on auxiliary sciences. The next lecture will focus on an auxiliary science or something that is not directly part of the supply chain but is essential knowledge for bringing state-of-the-art optimization to your supply chain. See you next time!