ROI = Return On Inventory?

ROI stands of course for return on investment. However, the idea that every euro or dollar ‘invested’ in inventory brings a certain return in terms of profits is a powerful thought. When looking at inventory from this angle, two questions arise:

- Are profits earned by a product versus the capital invested in stocking it (i.e. ROI) similar over the product portfolio?

- If the ROIs of the various products are heterogeneous – how can the overal ROI delivered by the inventory be maximized?

As you will have guessed, the answer to the first question is a clear ‘NO’. The return generated by a product for the euros invested in stocking it differs vastly from product to product. Two aspects have a major impact.

First, the gross margin of a product directly affects the ROI. This is obvious, and product managers naturally try to build a portfolio with high margins in mind. However, many other considerations come into play such as the coverage of the product portfolio for example. Adding more products to the portfolio is often also a strategy for growth.

The second aspect is more subtle, but equally important: The amount of stock that is required to provide a desired availability (i.e. service level) varies significantly among products. The main driver here is the volatility of demand - the higher the uncertainty of the future demand, the higher the inventory level required to assure a given service level.

As an example, lets imagine two products with the same gross margin that sell the same number of units during the year, thus generating the same amount of annual gross profit. However, product A sells the same amount each week with a high certainty, while product B is much more erratic with no sales for weeks and large orders in others. To achieve the same availability or service level for both products, the safety stock for product B will be a lot higher than for product A, where very little uncertainty and therefore safety stock requirement is given. As a result, product B requires much more units in stock than product A to achieve the same annual profit. The ROI for product A is therefore significantly higher.

Businesses continually work on maximizing their return on capital employed (ROCE). Inventory is a significant part of the capital invested by most retailers, and therefore an important opportunity for optimization. The good news is that the potential for optimizing the ROI of your inventory by****taking advantage of the heterogeneous ROIs across your catalog is large.

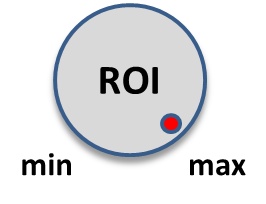

The latter is done by finding the optimal service level at which an SKU produces the best ROI within the constraint of a set inventory budget. As a result availability and revenue can be increased for a given inventory budget, or cash can be released from inventory while maintain the overall availability.

The analysis behind this optimization however is not trivial given the non-linear correlation between service level and inventory levels. Additionally, a set of ‘strategic’ constraints such availability goals for certain products need to be taken into account.

This is a challenge which we plan to take on in the near future, the goal being a fully automated ROI optimization over the product portfolio for a given working capital sum. As an output, the system will determine service levels per SKU that give the highest availability (and therefore revenues) for a chosen inventory budget.

Excessive inventory reduces the return on invested capital, but too little inventory diminishes profits as well. The optimal inventory level is therefore a trade-off between stock-out cost and inventory cost, and falling too far on either side of the optimum will negatively impact your business. Our plans for service level optimization will leverage our forecasting technology. Stay tuned.