00:00 Introduction

02:44 Car longevity and car repairs

05:08 The story so far

09:40 Crafting a supply chain persona (recap)

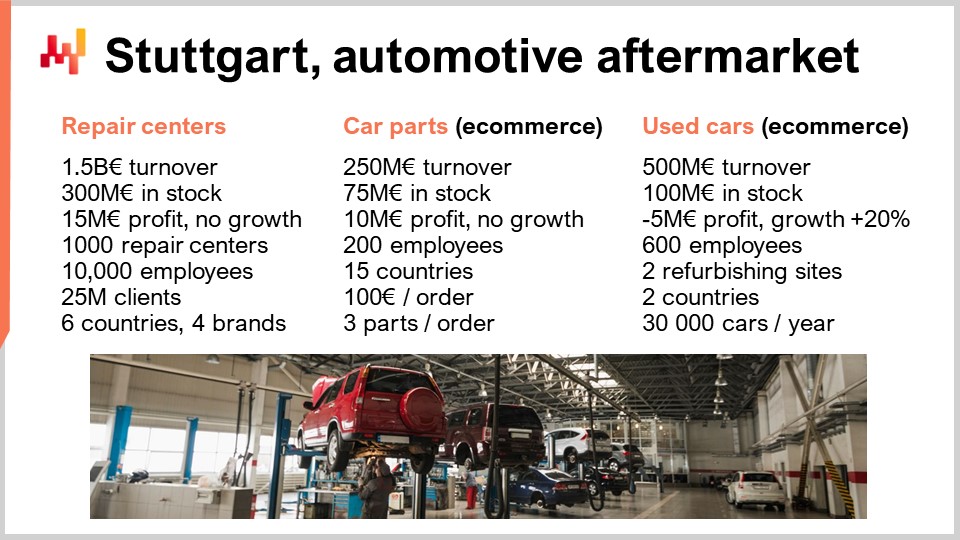

11:43 Stuttgart, automotive aftermarket

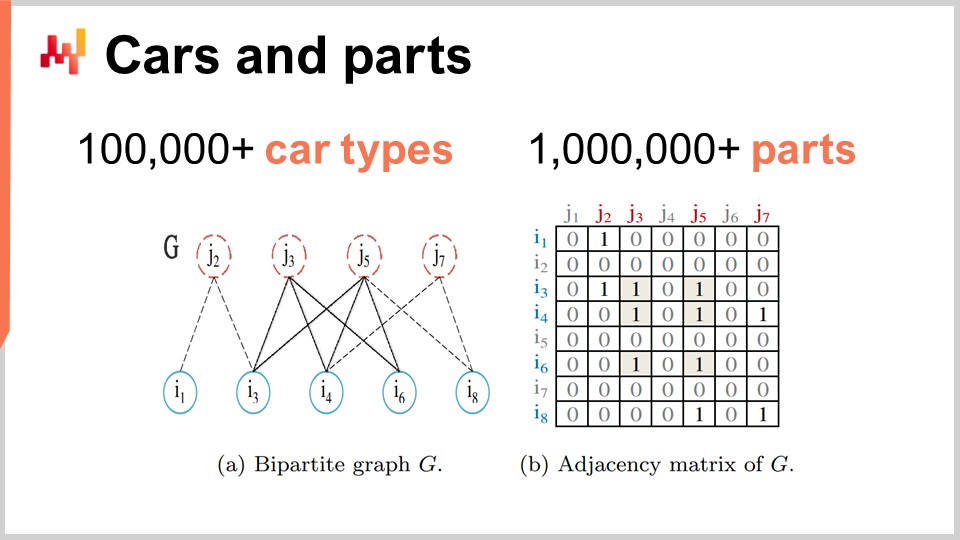

14:27 Cars and parts

21:48 Repair centers

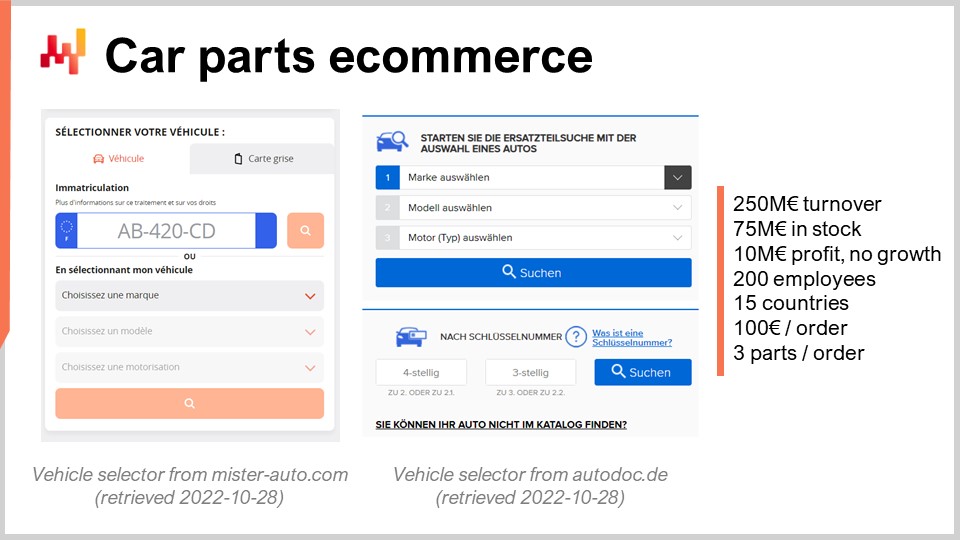

34:01 Car parts ecommerce

46:52 Used cars ecommerce

55:53 Revisiting cars and parts

01:01:38 Conclusion

01:03:20 Upcoming lecture and audience questions

Description

Stuttgart is a fictitious automotive aftermarket company. They operate a network of stores delivering car repairs, car parts and car accessories. In the early 2010s, Stuttgart also started two ecommerce channels, one to buy and sell car parts, and one to buy and sell used cars. Stuttgart attempts to deliver a high quality of service in the complex and competitive European automotive market that features tens of thousands of distinct vehicles and hundreds of thousands of distinct car parts.

Full transcript

Welcome to this series of supply chain lectures. I’m Joannes Vermorel, and today I will be presenting Stuttgart, a supply chain persona dedicated to the automotive aftermarket. Automotive is the industry of industries; the automotive aftermarket alone is a very large industry, about the same scale as fashion or aviation in Europe. In 2022, there were 560 passenger cars for 1,000 inhabitants on average. Cars in Europe are 11 years old on average, while in the USA, they are 12 years old. A passenger car will have three to four owners on average during its lifetime.

It shouldn’t come as too big of a surprise if the supply chain challenges faced by the automotive aftermarket tend to have their own very specific supply chain flavor that differs substantially from most of the other verticals. The goal of this lecture is to outline the supply chain-specific challenges faced by the automotive aftermarket. In order to do that, this lecture introduces Stuttgart, a fictitious company intended as a supply chain persona dedicated to the automotive aftermarket. For this persona, I will survey a series of challenges faced by this industry, and by the end of this lecture, you should be able to assess whether a supply chain solution intended for this vertical is missing the point or not.

Between supply chain textbooks and supply chain software vendors, there is no shortage of methods and technologies that are supposed to address most, if not all, the supply chain challenges. Yet my own personal experience indicates that those general solutions tend to be rather weak when it comes to the nitty-gritty details of a specific vertical. Upon closer inspection, most solutions appear to be chasing some meta problems or some misunderstood and mischaracterized problems.

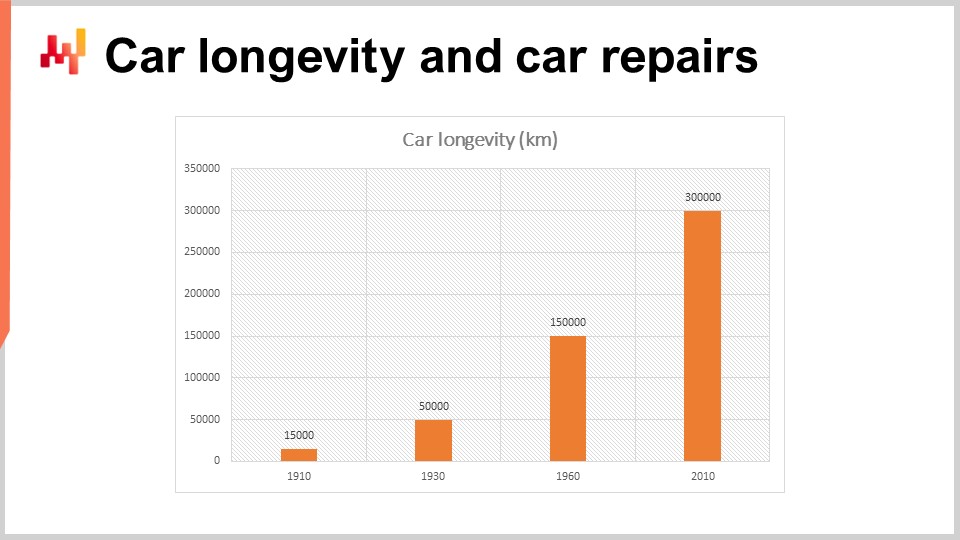

The primary automotive market focuses on manufacturing and retailing cars. The relative importance of the automotive aftermarket compared to its primary market is shaped by two aspects that are working in opposite directions: the longevity of the car and the reliability of the car. Longer-lasting cars increase the market size of used cars and increase the number of revisions that happen, on average, during the lifetime of a car. On the contrary, more reliable cars decrease the frequency and the magnitude of the revisions, as well as the incentives for car owners to change cars. If your three-year-old car is as good as new, there is very little incentive to get a new one.

During the last century, car longevity has increased tenfold, while car reliability has increased more than 100-fold. In 1920, 100 kilometers was already considered a sizable distance to operate a car without any maintenance of any kind. Nowadays, most cars can operate 10,000 kilometers without a revision. This is a stunning technological achievement, although the improvement of the roads themselves did also contribute to this progress. Modern cars would not exhibit the same reliability if they had to operate over the dirt roads that were commonplace a century ago.

This trend is still ongoing. The mechanical components of electric vehicles tend to be even more reliable and longer-lived than their gas-powered counterparts. At face value, these numbers could be read as a complete collapse, over the course of a century, of the automotive aftermarket compared to its primary market. However, the automotive aftermarket still represents about half of the profit of the automotive industry. Indeed, putting aside some luxury segments, the primary automotive market is competing fiercely on vehicle prices, boosting the relative importance of its aftermarket.

This series of lectures is dedicated to the study and practice of supply chain. There are more than 2,000 lectures that are publicly available online from the Lokad website. It may feel a little bit overwhelming to the audience; however, the reality is that supply chains are complex. These lectures merely reflect the pre-existing complexity. Moreover, a modern practice of supply chain must make the most of the software capabilities that are accessible to us nowadays. This is one of the insights behind the quantity of supply chain perspectives pioneered by Lokad a decade ago and presented through this series of lectures.

This series has been progressing up to Chapter 7, but today we are revisiting Chapter 3, which is dedicated to supply chain personas. The first chapter is a general overview of supply chain, both as a field of study and as a practice. This chapter lays the groundwork for the discussions that follow. In this chapter, supply chain is defined as mastery of optionality when considering the flow of physical goods. We review what this definition implies when considering the capabilities of modern software.

The second chapter is dedicated to methodologies. Supply chain defies most naive methodologies. In particular, supply chain requires systems thinking; we can’t just isolate the parts, we need to take into account the whole. Adversarial behaviors are all over the place, and it is not reasonable to expect people inside and outside the company to not have agendas of their own.

The third and present chapter is dedicated to supply chain personas. A supply chain persona represents a method to study supply chains by starting with an exclusive focus on the problems, purposefully postponing all the discussions that are relative to the solution part. Today, our focus is on Stuttgart, an automotive aftermarket persona. I will be revisiting this concept of supply chain persona in a minute.

The fourth chapter is dedicated to the auxiliary sciences of supply chain. These auxiliary sciences are not supply chain per se, yet they are essential for a modern practice of supply chain. It is not considered any more a reasonable proposition that a physician can be both competent and entirely ignorant of chemistry. In the case of supply chain, my proposition is that it should not be considered any more a reasonable proposition for a supply chain practitioner to be both competent and yet entirely ignorant of software matters.

The fifth chapter is dedicated to predictive modeling. A high quality of service almost invariably reflects some kind of anticipation of the future. Time series and time series forecasts are the old-school way to look at the problem. Predictive modeling represents a more general approach beyond time series and point forecasts. In particular, this fifth chapter covers probabilistic forecasting, an approach that embraces uncertainty instead of dismissing it.

The sixth chapter is dedicated to decision-making, as many, if not most, of the decisions in supply chain have to be quantitative in nature. Most decision-making problems present themselves as mathematical optimization problems. This sixth chapter covers techniques that are suitable to perform these optimizations, typically leveraging the predictive models introduced in the fifth chapter as input.

Finally, the seventh chapter is dedicated to the execution of the quantitative supply chain initiative within the company. So far, the tactical perspective has been covered, including the goal, the role, and the timeline. I will be revisiting this chapter later to discuss the strategic matters.

A supply chain persona is a fictitious company. This persona is introduced to shed light on a series of specific supply chain problems as they present themselves in a given vertical. The persona postpones entirely all the solution-related discussion to exclusively focus on the problem side of the situation. Indeed, in supply chain, there is no such thing as a solution without an agenda. Vendors are pushing for solutions that happen to match their software products, consultants are pushing for solutions that happen to match their competencies, and academics are pushing for solutions that happen to match their publications.

As a methodology, the persona is an alternative to case studies that fare poorly in supply chain. In supply chain, case studies are severely undermined by the ever-present adversarial incentives. The finer points of this argument are presented in the second chapter of this series of lectures. A persona is intended to be difficult to craft but easy to contradict. It’s pretty much the opposite of a case study. The persona must resonate with supply chain practitioners of the vertical, no matter what solution happens to be in place.

The persona must also survey as extensively as possible the supply chain problems faced by the company, not just the easy ones that happen to benefit from a supposedly known solution. The persona must quantify the salient aspects of the situation, and finally, the persona must qualify what makes the problem being presented truly difficult. It must outline the sort of conflicting forces that are at play.

Thus, let’s proceed with the persona of interest today. Stuttgart is a fictitious company that operates in the automotive aftermarket. The company was founded in 1970 as an independent brand of repair centers. Unlike the representatives of the car manufacturers that were centered on their own car brands at the time, Stuttgart was founded as a multi-brand repair network from the very start. For 40 years, Stuttgart operated exclusively through its brick-and-mortar representatives, growing as a lower-cost alternative to the repair networks of the car manufacturers.

Stuttgart, like most of its peers, missed the early internet wave of the 2000s and finally decided to move online a decade later in 2010 with two online ventures. The first one is dedicated to selling car parts, and the second one is a marketplace to buy and sell used cars.

The e-commerce dedicated to car parts appears simple: people go to the webshop and buy parts that their vehicle needs. However, as we will see, things are not as simple as they appear. Selling car parts presents specific supply chain challenges. For the used car marketplace, Stuttgart buys the cars and refurbishes them before putting them back on sale. The company positioned itself as more than a simple intermediary that operates a marketplace. Stuttgart buys the cars, which lets sellers have control over the exact date when they give up their vehicle. Also, by refurbishing the cars, Stuttgart can sell warranties ranging from one year to three years for the cars being resold. This ensures a more uniform buyer experience and largely mitigates the pitfall of having some customers experiencing exceedingly negative buying experiences with a newly acquired vehicle and damaging the Stuttgart brand.

In terms of workforce, the repair centers still dominate with over 90 percent of the employees of the group. However, in terms of revenue, the two online divisions now represent one-third of the business, with some segments still growing.

The whole business of Stuttgart revolves around cars and car parts. It is obvious that there are many different cars and that there are an even greater number of car parts.

In order to organize and potentially optimize the supply chain of Stuttgart, we need to identify and characterize both cars and their parts. Let’s start with the cars themselves: how many different cars are there in Europe exactly? This question is important because two different cars may require different parts to be repaired, and also two different cars are likely to be valued differently by the market independently from their respective mileage. Unfortunately, this question has no immediate answer.

Indeed, nowadays, car manufacturers offer a wide array of options for any car model. As a result, if we were to say that two cars are the same if and only if they have the exact same physical makeup (ignoring the minute divergence caused by differences in the manufacturing process), then we would nearly have as many existing cars as there are cars in Europe, that is approximately 300 million passenger cars. However, this massive number does not really make sense, as there are many cars that are very similar, even if every unit presents some minor variation, like the color of the paint.

Conversely, if we were to say that two cars are the same just because they are sold under the same name, then we would be grossly lumping together units that are clearly very different. For example, Volkswagen has been selling its Golf model since 1974; however, this model covers eight generations of cars, the recent ones having very little in common with the earlier ones.

The most common way to define what constitutes a distinct type of car consists of looking at the cars through the lens of mechanical compatibility. Two cars have the same type if and only if all the parts that fit on one car also fit on the other one. This definition is aligned with the operational needs of the automotive aftermarket. It turns out that there is a short series of specialized companies that precisely serve the automotive aftermarket and establish their own list of distinct car types based on this very definition. Those specialized companies sell their databases to automotive aftermarket companies like Stuttgart, typically as some kind of subscription, as the databases need to be routinely refreshed. New cars and new parts enter the market all the time.

According to those specialized companies, there are over 100,000 distinct car types in Europe. This number is much lower than the original 300 million cars but still quite large, especially from a supply chain perspective. Stuttgart is buying one of those subscriptions to support its own operations. We will revisit the fine print later in this lecture.

Alongside the list of car types, Stuttgart also needs a list of distinct car parts. This also begs the question: how many distinct car parts are there in Europe exactly? Again, the answer is not straightforward. An easy but incorrect approach would consist of surveying all the part numbers as advertised by car manufacturers. Unfortunately, as the automotive aftermarket represents about half of the profit of car manufacturers, manufacturers have developed a few techniques to extract a little more from this market. One of those techniques consists of segmenting the market according to the willingness to pay of the customers, the car owners. A customer who has purchased an SUV has a greater willingness to pay, all things considered equal, than a customer who has purchased a compact car. If both the SUV and the compact car share the same mechanical part, it is in the interest of the manufacturer to relabel the part mounted on the SUV under a different part number in order to have this part sold as a spare at a higher price to SUV owners.

Unfortunately, this practice interferes with the operations of Stuttgart. Stuttgart positions itself as a competitive alternative to the repair networks of the car manufacturers. Stuttgart does not benefit from acquiring the same part at the premium price. If the two parts are physically identical, it is in the interest of Stuttgart to buy the cheaper one. The same specialized companies that survey the list of car types also happen to survey the car parts as well. Those parts databases attempt, among other things, to provide all the necessary information to deduplicate the part numbers and to obtain a list of truly distinct car parts.

According to those specialized companies, there are still over a million distinct car parts in Europe. However, many parts are rare, and many parts are not even intended to be ever replaced. Nevertheless, those parts belong to the automotive landscape and thus add complexity to the operations of Stuttgart. Finally, we have to consider the list of mechanical compatibilities between those 100,000 car types and those 1 million car parts. Indeed, for a given car type, Stuttgart needs to identify which parts happen to be compatible with this vehicle.

It turns out that the specialized companies selling both the list of car types and the list of car parts also sell the part-vehicle compatibility matrix. Data-wise, this matrix presents itself as a list of pairs of a car type plus a car part, indicating that there is a mechanical compatibility between the two. In Europe, this list includes over 100 million pairs. Mathematically, this list can be seen as a bipartite graph. Unfortunately, this list is too vast to be empirically verified in full. In practice, based on studies conducted by Lokad itself, those datasets seem to have about a three percent error rate, spread roughly equally between the false positives (claiming a mechanical compatibility while there is none) and the false negatives (omitting a mechanical compatibility that actually exists).

With those elements in place, let’s proceed with the first division of Stuttgart: repairs represent the traditional segment of the Stuttgart business. The company positions itself as the trusted expert that takes care of your car at an affordable price. When the operations are adequately executed, Stuttgart earns a durable trust from its customers. The automotive aftermarket is a market of need rather than a market of wants. People need their cars to be in working order. The mission of Stuttgart is to let the maintenance happen with the least amount of friction. The network includes over a thousand repair centers. Repair centers are relatively small business units with less than a dozen employees on average.

Customers request both scheduled and unscheduled interventions from the repair centers. Ideally, from the customer perspective, repair centers should be able to serve any request at any point in time. However, each repair center has a limited capacity. For every type of intervention, the repair center can only process so many cars at any point in time. Limits are imposed by the available space, equipment, and the workforce. Thus, one of the first supply and demand issues to be addressed is the allocation of the workforce. Indeed, while space and equipment can also be modified, those represent infrastructure-level investments that cannot usually be adjusted from one day to the next. However, the workforce can be adjusted on a daily basis, or even on an hourly basis, by properly scheduling the shifts. Having more mechanics available gives a greater capacity to serve customers, especially their unscheduled requests.

However, it also means for the company a greater risk of paying idle employees if there is not enough work to keep those mechanics busy. Also, every single mechanic is not qualified for all the operations. It’s not just about figuring the headcount per day per repair center, but about composing a staff on any given day that lets the repair center complete all the desirable operations for the day, both scheduled and unscheduled.

However, Stuttgart is not entirely passive when it comes to schedule requests. Indeed, by default, there might be a systematic excess of demand on Saturdays, for example, and the repair centers can’t process it all. Stuttgart can adjust its public pricing by either charging a little more during the weekend or charging a little less during the weekday. Choosing one versus the other is a matter of communication. However, a careful adjustment of those prices can be used by Stuttgart to smooth the demand during the course of the week so that the customer demand follows a little more closely the capacity constraints of the repair centers. Picking the right pricing policy to achieve that is a supply chain challenge.

Moreover, when repair centers are not too distant from one another, as is the case for many cities that have several repair centers, there is the possibility to reallocate the staff from one repair center to another during the day if a center finds itself with an excess of requests while another center is facing the opposite situation. Deciding whether a last-minute reassignment is desirable or not is another supply chain challenge. As a side note, yield management and dynamic workforce allocation do not traditionally fall under the supply chain umbrella as implemented by many organizations. However, from the quantitative supply chain perspective presented in this series of lectures, all the variables that are readily available to create a better, more profitable alignment of demand and supply are to be part of the supply chain.

Getting back to more traditional supply chain topics, many interventions on cars require parts to be available. Thus, Stuttgart must decide which parts should be kept in stock in every repair center. As discussed previously, there are over a million distinct parts in the automotive aftermarket. Keeping all those parts in stock in every location is not a realistic proposition. Thus, the assortment is a largely incomplete selection of parts by necessity. If a part is not readily available in the repair center, it has to be ordered from a central parts warehouse. This process will be discussed in greater detail in a few minutes.

However, parts in the repair centers serve two purposes. The first purpose is obvious: to make it possible to perform the repairs on the vehicles. The parts are stocked in the repair centers in order to reduce the immobilization delays for the customers. The second purpose is less obvious but no less important: to make the repair center look like a nice, colorful, appealing automotive center. Those parts are intended to be permanently put on display, and they contribute to the merchandising strategy of the repair centers. Those parts are frequently accessories. They are not the primary reason why the customers went to the repair center in the first place, but the customers can be tempted to take an accessory to improve their driving experience. The optimization of the inventory in the repair center must fulfill these two goals: service and merchandising, which are only partially aligned.

The return of parts from the repair center to the warehouse is also a concern. Indeed, when considering a vehicle in order to pick the right parts, the staff routinely checks the part-vehicle compatibility matrix that we discussed previously. In the past, software used to be provided as CDs and DVDs; nowadays, it’s usually a subscription featuring online access. Indeed, considering the complexity of the automotive market, even the most experienced mechanics don’t have prior experience with many situations. However, the compatibility matrix has errors and ambiguities. As a result, occasionally the mechanic orders the wrong part. Shipping parts back and forth costs money, and thus it is not clear that immediately returning a part that turns out to be incompatible is the most economical option. Yet, if a part isn’t returned immediately, it is at risk of becoming dormant inventory in the repair center. Indeed, the demand for this specific part might be very low if we look at this one repair center. Thus, supply chain management must decide for every part in stock in every repair center if and when it should be sent back to the warehouse.

The network of repair centers includes four warehouses. The primary purpose of those warehouses is to serve the car parts requested by the repair centers. There are daily shipments from the warehouses to the repair centers. As there are only four warehouses against one thousand repair centers, each warehouse can afford a much larger assortment of parts in stock than any repair center. The warehouse is expected to deliver a high quality of service for most parts, except the truly long-tailed ones. Any servicing delays mean an unhappy customer who won’t be able to use his or her vehicle on the day it was originally promised by the repair center. The stock held in the warehouse is also used to buffer distant suppliers, some of them being in Asia, that have lead times of several months.

The operations of the warehouses are complicated by the sheer diversity of parts that come in many shapes and sizes. Fragile, oversized parts like winches and overly bulky ones like tires typically benefit from special treatment from a logistical perspective. However, logistical concerns are beyond the scope of the present discussion. Beyond the quality of service, the warehouses are also integral to the central purchasing strategy of Stuttgart. By purchasing parts in bulk, typically meeting MOQs (minimum order quantities) or price breaks, Stuttgart can get better unit prices from the OEMs (original equipment manufacturers). Achieving low purchase unit prices for parts is critical for Stuttgart to remain competitive and profitable.

Optimizing the warehouse inventory levels for Stuttgart involves the usual mix of uncertain future demand, uncertain future lead times, and the economies of scale associated with larger shipments. However, the optimization also features one specific twist that is quite specific to the automotive aftermarket: the mechanical compatibility of parts. Indeed, being out of stock for a given part number is inconsequential if there is a well-stocked alternative in the warehouse. The quality of service at the warehouse level should not be read through the direct availability of the part numbers themselves. Instead, the quality of service should be read through the availability of parts that match the intended repairs. Indeed, to some extent, Stuttgart can steer its own stream of requests from one part number to another part number as long as both part numbers are compatible with the destination vehicle. The part-vehicle compatibility matrix is once again an essential ingredient to perform such a substitution.

In many other verticals, cannibalization and substitutions are evasive and difficult to assess. In the automotive aftermarket, however, it’s mostly a given, yet it starts with a 100 million-line dataset – the part-vehicle compatibility matrix. Even considering a compact, in-memory representation, the footprint of this dataset is one gigabyte or so. This dataset is small enough to fit in the memory of a modern computer, but it is still large enough to create massive computing overhead if every single supply chain decision requires a linear scan of this dataset. Whatever numerical recipe is ultimately adapted to optimize the Stuttgart supply chain, this recipe should treat the compatibility matrix as a first-class algorithmic citizen.

The second division of Stuttgart is the parts e-commerce. The car parts e-commerce lets customers buy parts and perform maintenance operations themselves. To a limited extent, this channel competes with the services provided by the repair network. This explains why Stuttgart entered this market relatively late in its history, in 2012, as it didn’t have much support from its own organization while doing so. Nevertheless, Stuttgart entered this market as online competitors were starting to capture sizable market share in several key segments, aggressively seeking better prices like professional drivers, for example.

The first hurdle to overcome for the e-commerce front end is to provide reassurance to the customers that the part they are about to order is mechanically compatible with their vehicle. For this reason, the Stuttgart website starts by asking the visitors to identify their vehicle. This method varies depending on the country in Europe. In France, this is typically done by entering the plate number. In Germany, this is typically done by providing the HSN and the TSN, two special numbers. In other countries, this can be done in more laborious ways, for example, by specifying the brand, family, model, and then the model type.

Once the car type has been entered, the online catalog is trimmed down to the list of parts that happen to be mechanically compatible. Once more, the part-vehicle compatibility matrix plays a critical role here. Once the vehicle has been selected, the customer starts to navigate the e-commerce website toward the type of part of interest, for example, brake pads. The type of part is sometimes referred to as the function. However, for most vehicles, for a given function, there are dozens or more of distinct suppliers that happen to provide a part fulfilling the function.

As a side note, when selling car parts online, the lingering errors that exist in the part-vehicle compatibility matrix prove to be fairly damaging to the vendor. Indeed, with a brick-and-mortar repair network, getting the wrong part means reordering a new part and one or two days of extra delays. The delay is an inconvenience for the customer, but the resolution of the original error – getting a new part that actually fits on the vehicle – is largely transparent. In the e-commerce case, the customer, who is not an automotive professional, will struggle with the incompatible part and most likely waste a lot of time trying to figure out what went wrong. A large amount of customer loyalty and goodwill can be lost over a single incompatible part.

Thus, the car part division of Stuttgart, like its competitors, is trying to add its own layers of corrections on top of the part-vehicle compatibility matrix as originally provided by the third-party specialized company. However, considering that it’s a 100-million-line dataset and that, furthermore, it evolves by a few percent every year, the task is daunting.

At this point, from a supply chain perspective, we observe a whole series of supply chain decisions that must be made for every single part being sold online. First, every part needs a price. However, the price can be made dependent on the lead time being promised. Indeed, Stuttgart can offer a short deadline for delivery in exchange for a higher price, or conversely, can offer a lower price if the customer is amenable to waiting a few weeks. The varying price doesn’t merely reflect alternative shipment methods but also alternative sourcing options available to Stuttgart. If the customer is willing to wait, then Stuttgart can bypass most of the inventory risk and pass some of the savings to the customer, hence lowering the price. Separately, there is also a concern price-wise of the competitors’ prices. I will be getting back to that in a minute.

Second, on top of a price, every part needs a rank. Indeed, on the website, for a vehicle type, for every function, there is a list of compatible parts. Frequently, there are a dozen of them. Thus, the display rank within the webpage has a significant impact on the purchasing behaviors of the customers, especially if the parts are similarly priced. Indeed, parts at the top of the list tend to get the bulk of the sales. Conversely, parts at the bottom of the list, especially if they are on the second page and require an extra click, get much fewer sales.

In addition to the rank, many online stores leverage additional markers, like marking some parts as “star” or “first choice” or “top seller.” Again, the classical perspective on supply chain would not consider the attribution of those visual markers as a supply chain problem but probably as a marketing problem. However, those markers have a sizable impact on the level of demand generated for a specific part within the selection. Those markers can both mitigate or amplify a supply chain issue. The ranks and markers can accelerate the sales of an overstocked part, mitigating the issue, or they can accelerate the sales of a part that is already out of stock, hence amplifying the issue.

Supply chain is about profitably balancing the demand generated by the company and the supply it can deliver stock-wise. The problems of the e-commerce division of Stuttgart are somewhat similar to the ones faced by its warehouses. The online store can leverage the central purchasing unit of the repair network to gain access to better prices. However, the online store has its own fulfillment center, which is optimized for numerous orders, each involving only a few parts on average – three or four.

The storage capacity of the fulfillment center is limited, as it leverages a chaotic storage system. It has been designed for throughput, not storage density. Stuttgart must decide the exact list of parts that are ready to be shipped through the chaotic storage system. Conceptually, whenever a part has been shipped, there is a newly available slot in the chaotic storage system. However, slow-moving inventory inevitably creeps in. When this happens, Stuttgart has several options at its disposal. Stuttgart can remove the parts from the fulfillment center, putting them back in a warehouse, which is a more appropriate place for slow movers. Alternatively, Stuttgart can promote the parts either by price, rank, or some markers, as discussed previously.

When Stuttgart sells a part, it promises a specific item and a delivery date. Ultimately, due to unforeseen events, Stuttgart may sometimes find itself unable to fulfill the original promises. However, if a compatible part happens to be available, or even better, if a slightly more expensive compatible part happens to be available, then Stuttgart can propose to the customer a replacement at no cost for the part. Deciding whether the customer loyalty to be gained is worth the commercial gesture is, in part, a sales and marketing concern. However, this substitution is also a supply chain concern, as it diminishes the stock level of another part and may, in turn, generate another stock-out situation. Thus, addressing this question of substitution is a supply chain concern just as well as it is a marketing and sales concern.

Now, as promised, let’s get back to the prices of the parts. Stuttgart leverages a competitive intelligence specialist to get all the part prices of its key competitors on a daily basis, typically scraping their websites. This is done automatically, and those competitors are responding in kind by extracting the prices from Stuttgart’s website on a daily basis as well.

Let’s do a thought experiment and see what happens when Stuttgart positions its prices against those of its competitors for a given part. If Stuttgart exceeds the price offered by competitors, then Stuttgart will slowly but surely lose its market share. Indeed, most customers may not compare the prices every single time, but they all do it occasionally, and they will switch to the competition if Stuttgart proves to be an uncompetitive option. Conversely, if Stuttgart underprices a competitor, then this competitor will most likely seek to align its prices. Indeed, this competitor has its own competitive intelligence specialist, and this competitor will detect the lower price from Stuttgart and will attempt to fix the price gap. If Stuttgart, in turn, attempts to maintain the price gap, then this competitor will keep lowering its prices even further. The net result of this is a price war, leading to vanishing margins for both Stuttgart and its competitor.

Thus, if both overpricing and underpricing lead to detrimental situations for Stuttgart, a default pricing strategy should be to seek pricing alignment. And this insight is not a pure matter of game theory; seeking pricing alignment is, in the real world, the dominant strategy for most companies operating in the automotive aftermarket.

However, once more, the part-vehicle compatibility metric intervenes to complicate the price alignment strategy. Stuttgart is only selling a fraction of the 1 million-plus parts that are available in the automotive aftermarket. Indeed, thanks to the mechanical compatibilities, it only takes a fraction of the list of parts (about 100,000 parts) to serve almost the entire automotive market. The competitors of Stuttgart are doing the same; they too are only selling a fraction of the worldwide list of parts. As a result, many, if not most, of the parts sold by competitors are not sold by Stuttgart, and conversely, many, if not most, of the parts sold by Stuttgart are not sold by any given competitor.

However, at the end of the day, both Stuttgart and its competitors are putting offers on display that compete for the same need – the same function in a given vehicle that requires replacement. Thus, the price alignment perspective remains valid, although it cannot be implemented through a naive one-to-one part comparison strategy.

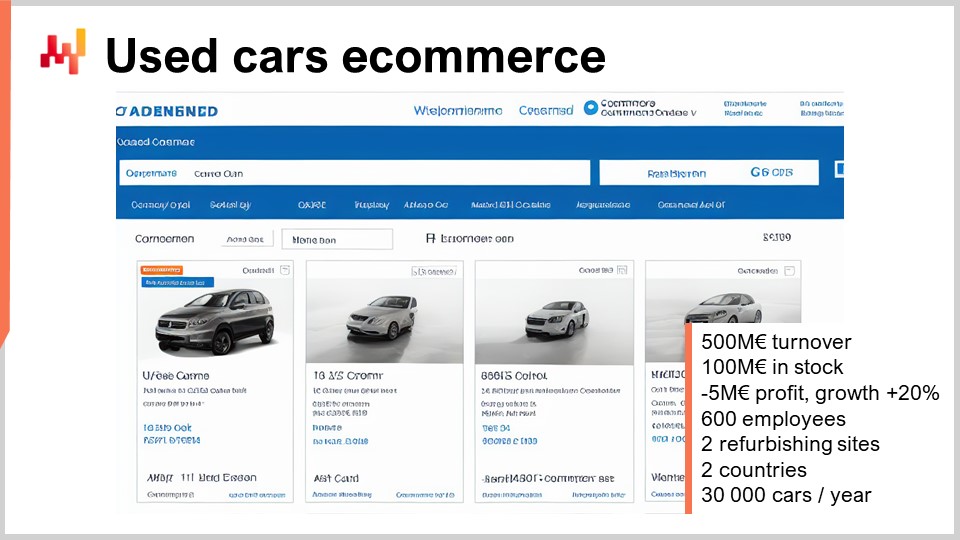

The used car e-commerce is the third division of Stuttgart. The used car e-commerce lets people buy and sell cars. Historically, Stuttgart could have entered the second-hand car market earlier than 2010 through a brick-and-mortar approach, yet it didn’t because its network of repair centers wasn’t a good fit for buying and selling cars. Repair centers aren’t large enough to accommodate many parked vehicles; the parking spaces are used to accommodate vehicles pending interventions or pending customers coming back to pick up their vehicles. Thus, Stuttgart entered this market relatively late, in 2010, as an online player, leveraging its brand to gain market awareness.

Unlike the first generation of online marketplaces that let people directly transact with one another, Stuttgart buys used cars on one side and then resells them on the other side. This approach allows Stuttgart to add value in multiple ways. On the buying side, for people who want to sell a vehicle to Stuttgart, the company provides an instant buy service for those customers. This removes uncertainty both in terms of delays and price when selling the vehicle. On the selling side, for people who want to buy a vehicle, Stuttgart refurbishes the vehicle and provides a one, two, or three-year warranty for the vehicles. Once again, this removes some of the uncertainty associated with the risk of car breakdown, a risk that grows with the mileage of the vehicle.

From a supply chain perspective, this is a fairly unusual situation. Stuttgart operates an inventory of cars where each item, a vehicle, has its own unique set of attributes, not merely the car type and its options, but also its mileage and its overall state of wear. In order to replenish its car inventory, Stuttgart cannot issue purchase orders. Instead, Stuttgart advertises its marketplace and waits for people to propose their vehicles to be acquired. Stuttgart provides an instant online, non-contractual quotation for this. If a customer confirms their interest for the non-binding estimate, they can have an expert provided by Stuttgart inspect the vehicle and finalize the offer for this vehicle.

The higher the buy price offered by Stuttgart, the better the odds that the customer will accept the offer. However, a higher buy price also means smaller margins and possibly longer delays to resell the vehicle afterward. Thus, the supply chain practice of this division at Stuttgart boils down to two core numerical recipes: a buy-side quotation recipe and a sales-side quotation recipe. The buy-side recipe tells Stuttgart what price point is to be offered to a customer presenting their vehicle. The sell-side recipe tells Stuttgart what price point to put on display for every single vehicle that happens to be in the inventory.

The two numerical recipes are fundamentally coupled. There is no such thing as a good buy price if Stuttgart cannot profitably resell the vehicle afterward. Similarly, there is no such thing as a good sale price if customers aren’t willing to acquire a fresh vehicle at that price. In Europe, each country has its own specialized companies that establish what is supposed to be the fair market value of each vehicle, taking into account the mileage and the options. In France, that would be the Argus, and in Germany, that would be the DAT.

Stuttgart acquires the pricing dataset sold by those companies. However, to a large extent, Stuttgart is in the business of outperforming what is supposed to be the fair market value of cars. Indeed, Stuttgart can use its own historical data to refine those prices beyond what traditional companies can do. This situation illustrates once more why pricing should be considered an aspect of the supply chain practice. The inventory reflects the prices established by Stuttgart. Moreover, the inventory rotations are also largely governed by those prices. Most vehicles sold by Stuttgart could have been sold at a slightly higher price if Stuttgart had been willing to keep the vehicle in stock for a longer duration.

Pricing is challenging for this division because no price works in isolation. Buy prices cannot be decoupled from sale prices, and a vehicle’s price cannot be decoupled from the prices of other vehicles. A buying price for Stuttgart must be appreciated with regard to other opportunities that arise in the future. If Stuttgart faces a spike in buy opportunities, the company may not have the liquidity or cash to purchase all the vehicles that are being presented, even if the prices appear to be low enough to be turned into profitable transactions. In this case, Stuttgart must prioritize its investments dynamically, lowering its buy prices as it can afford to lose a higher fraction of those opportunities. Conversely, every vehicle put on display by Stuttgart competes with other vehicles. Lowering the sale price of one vehicle can vastly increase the odds of finding a customer for that vehicle on the marketplace supported by Stuttgart. However, this operation might be a pure effect of cannibalization if the customer would have bought another vehicle within the Stuttgart marketplace anyway.

The supply chain practice at Stuttgart must embrace cannibalizations and substitutions as it shapes its pricing strategies, no matter what those strategies turn out to be. On top of the vehicle itself, Stuttgart offers a minimum one-year warranty on the vehicle. This warranty allows Stuttgart to resell the vehicle at a higher price compared to pure customer-to-customer transactions. Since Stuttgart refurbishes the cars before reselling them and there is no complete technical diagnosis prior to the acquisition, only a simple inspection, there is an element of uncertainty in how many parts will be needed to complete the refurbishing operation for each newly acquired vehicle.

An accurate anticipation of the parts that will be needed to refurbish the car is important in order to adjust the buy price accordingly. Furthermore, when reselling the car, the two-year or three-year warranty extensions must also be priced properly, factoring in the risk of breakdown and its associated costs, which can go up to providing a full replacement vehicle. The supply chain practice at Stuttgart is the obvious candidate within the company to assess what boils down to probable future supply chain costs. Thus, even if the supply chain practice doesn’t have the final say on the pricing of those warranties, it certainly must be involved to make sure that the warranty isn’t sold at a loss.

Finally, as a minor but more conventional supply chain challenge, Stuttgart’s third division must also maintain an adequate inventory of parts to support the refurbishing operations themselves. Although it is largely a non-issue if refurbishing a car takes one or two additional days to complete, Stuttgart must ensure that the mechanics conducting the operations do not end up stuck and idle, waiting for parts to resume their work.

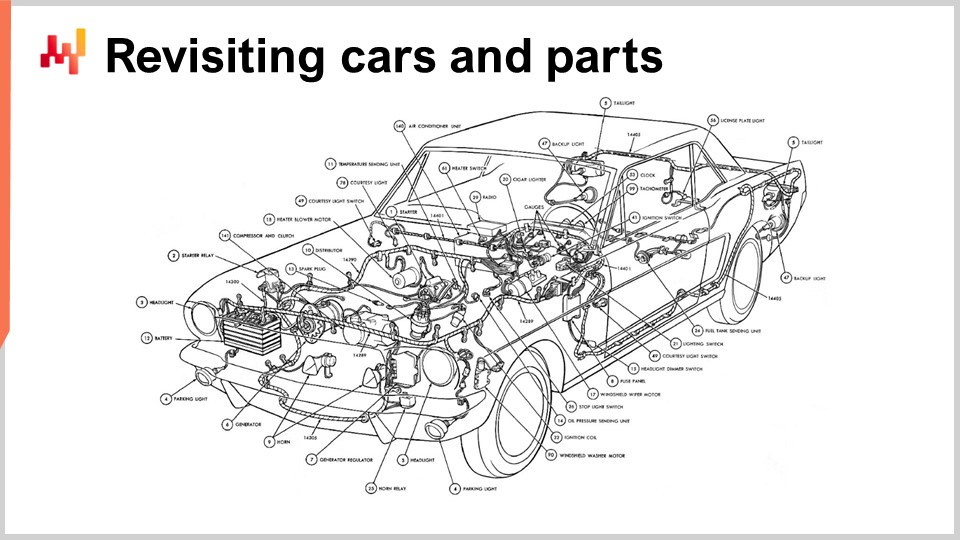

As we have now surveyed the three divisions of Stuttgart, let’s step back for a minute. We have approached the automotive aftermarket through a series of assumptions. We have assumed that there was a list of car types, a list of car parts, and a matrix that connects these two lists, including the mechanical compatibilities. As there are specialized companies in Europe that sell these datasets, these assumptions aren’t without merit. However, these lists aren’t the only way to look at the problem; there might be other, better ways.

Indeed, let’s reconsider the list of 100,000 car types. Does it really seem like there is such a staggering diversity of cars in Europe? Casual observations in the streets of Paris, London, and Berlin would rather indicate that a few dozen cars seem to represent the bulk of the market. Moreover, on closer inspection of the technical makeup of those cars, we can see that the situation might not be nearly as complex as it appears. For example, if we look at the braking systems of passenger cars, it turns out that in Europe, nearly all passenger cars share the same half a dozen braking systems—a relatively small number of variations. The engine, the gearbox, the braking system, and the steering system result in an explosive number of combinations, hence 100,000 car types, if we consider all the mechanical combinations that have ever been put into production.

Anecdotally, such a combinatorial explosion would nicely explain why mechanics in repair centers can operate at all without spending their entire days reading technical manuals. Every car that a mechanic encounters might be a unique combination of parts that he may never encounter again in his career. However, the mechanic most likely already has some prior experience with every single subsystem in the car. For instance, if there were 100,000 distinct braking systems, it would take several lifetimes for a mechanic to become familiar with all of them. But if there are fewer than 10, then it can be done in a matter of weeks.

A flat list of cars ignores entirely the internal mechanical structure of the cars. As a result, every minor mechanical variation within the car requires a new car type to be added to the list. Worse, for every newly introduced car type, a complete list of parts that happen to be compatible needs to be added as well to the part-vehicle compatibility matrix. This typically represents over a thousand extra lines that are nearly identical to the lines that were associated with the previous car type.

From an informational perspective, the part-vehicle compatibility matrix is an extremely verbose way to represent mechanical compatibilities. Neither the list nor the matrix conveys key technical insights, such as “the brake pad isn’t compatible with this vehicle because the brake pad belongs to an entirely different braking system.” It turns out that there are better, more concise, and more manageable ways to represent mechanical compatibilities: ontologies. Ontologies, which are a way to organize and structure the knowledge we have about entities—not just in the automotive aftermarket—can be used as a superior replacement for the plain extensive listing.

Ontologies can be used to revisit every single situation discussed today that involves mechanical compatibilities. Ontologies are beyond the scope of this lecture, as this talk is exclusively dedicated to framing the problems, not discussing their potential solutions. However, I am making a minor intentional exception here with ontologies to illustrate how difficult it is to even think about a problem if you don’t have a corresponding solution in mind.

Indeed, operating through a list of car types and through a list of car parts may seem like a given, a fact, until you realize it is not. It is an abstraction, a simplistic approach that comes with at least one severe drawback: everything has to go through the lens of a gigantic matrix that involves 100 million lines. This large dataset complicates everything as far as supply chain software is concerned. Worse, this complexity is largely accidental. The real intrinsic complexity of the part-vehicle compatibilities is several orders of magnitude lower. The very definition of the objects of interest is also, to some extent, part of the problem itself.

Supply chain textbooks and supply chain software typically jump right into supposedly generally applicable solutions like safety stocks, buffers, time series forecasts, or service levels. The adequacy of the solution is rarely challenged, and when it is, it is usually about inconsequential technicalities like going for weekly forecasts instead of monthly forecasts, or picking the mean absolute percentage error (MAPE) rather than the mean square error (MSE). This is missing the forest for the trees. When dealing with spare parts, the vehicles themselves are the true consumers of parts, not the people owning the vehicles. Mechanical compatibility is not some kind of analytical refinement to be applied on a pre-existing method; it should be the starting point and at the very core of the method. Through the Stuttgart persona, this should have become relatively self-evident at this point.

Furthermore, in this series of lectures, I approached pricing as an aspect of the supply chain practice. Pricing always shapes demand, but the relative importance of pricing compared to other concerns varies from one vertical to the next. The Stuttgart persona presents, for its used car division, a rather extreme case where inventory optimization is almost a pure matter of pricing. In terms of used cars, Stuttgart doesn’t get to pick any quantity; it only picks the prices.

In this lecture today, we have surveyed supply chain challenges at Stuttgart, a fictitious company operating in the automotive aftermarket. In the next lecture, which will happen on Wednesday, January 11th, we will revisit the predictive modeling chapter, that is the fifth chapter. I will be covering lead times. Indeed, lead times deserve a probabilistic forecast just as much as demand does. We’ll see how lead time forecasts can be combined with holistic demand forecasts. We will also review how future events, like stockouts that have yet to come, should be integrated into the predictive modeling approach. Indeed, in this series of lectures, we’re looking for programmatic patterns to address other classes of supply chain situations, not for a list of models.

Now, I will proceed with the questions.

Question: Electric vehicles have fewer parts and not so much compatibility across producers. Would inventory management one day become simpler than it is now?

This is a very good question. There has been a century-old trend of vehicles becoming more reliable and having fewer repairs per kilometer of travel. This means that when you have more reliable vehicles, especially if they have fewer parts, it diminishes the importance of the automotive aftermarket compared to the primary market. However, as you pointed out, there are other forces at play. First, electric vehicles are likely to be a new area with many competing standards, and thus there will be tons of parts introduced. So even if each car has fewer parts, if there are dozens of car manufacturers trying to establish their own standards, that might create quite a lot of extra parts. Additionally, considering that parts are very long-lived, there will probably be at least two or three decades of overlap between electric vehicles and gas-powered vehicles.

Ultimately, if we think one century ahead, yes, it might become easier. However, it’s interesting because when it becomes easier and cheaper, car manufacturers may envision an even greater diversity of cars. After all, if you have fewer distinct parts, you can think of providing a greater diversity of types of cars to your customers. There may be added value in having greater diversity. That being said, I’m not an oracle predicting what the automotive market will look like decades from now. It can go both ways, and although I would be exceedingly surprised if it becomes a simple market two or three decades from now, it is just so gigantic, and there will be so much left over. Gas-powered vehicles are still being manufactured today, and they will be operating on the roads for decades to come. It may ultimately get simpler, but it might not happen during my own lifetime.

Question: You said that compatibility data has about three percent errors. Is there a way to find those errors automatically?

The short answer is yes, there is, but it’s a very tricky proposition. Fundamentally, it is known as an unsupervised machine learning problem. You have a dataset of compatibilities, this adjacency matrix, and that’s all you have. It’s not like a supervised learning problem where you have correct examples. However, it turns out that it’s actually possible to engineer an unsupervised machine learning algorithm to automatically detect false positives and false negatives, and that’s precisely what Lokad does. We even benchmarked this with a client, testing whether the unsupervised algorithm was working or not, and yes, it is working. That’s how we assessed it, but this topic is too complex to be addressed in this Q&A session, so that will be left for another lecture.

Question: Can you share how you come up with the persona example and all the details that you present?

Yes, these personas are an amalgamation of many clients that Lokad has been serving for over a decade, particularly companies in the automotive aftermarket. Although the data and data points that I’ve presented today are not secrets, I made sure to pick information from public companies that make tons of information publicly available online. I merged this information with the experience I’ve acquired at Lokad to forge a credible persona. This is true for this persona and all the other personas I’ve presented.

The recipe is the same: Lokad serves a series of companies within a given vertical, we have experience, we’ve struggled intensely with challenges, and we’ve tested many solutions. Some of them turned out to be better than others, but every solution comes with an agenda. Through these personas, I try to present the core challenges that we faced, and frequently it took us years to fully grasp what the problem actually was. And then considering the numbers, as I mentioned, I did not use any of the extremely confidential data trusted to Lokad by our clients. Instead, I always checked that there are sources online that provide the numbers I present. This is a construction, and I typically readjust the numbers so that they make sense with regard to the scale of the persona that I’m crafting.

The next lecture will be on January 11th, a Wednesday, at the same time of the day, 3 PM Paris time. See you then.